Global warming has seen unpredictable weather across the world. Europe has seen one of the warmest winters on record, coinciding with the continued conflict in Ukraine. This has resulted in highly volatile power and gas prices that usually you would expect to result in increased margin requirements. However, in some cases the margin has actually reduced because of the historically low prices. This unpredictability has highlighted the impact on the margin requirements depending on the products traded, be it choice of exchange, bilateral versus cleared or the use of different contracts. The ability to forecast and optimise margin can have a significant impact on the level of margin paid and hence returns.

Weather

Mild weather in Europe over the winter has led to snowless ski resorts adjusting their offerings, with walking tours being introduced in Morzine and artificial waves being made available to surf in Verbier,

Meanwhile Spain recorded its hottest ever temperature for April hitting 38.8C at Cordoba airport.

For days a blistering heat wave hit the country with temperatures 10-15C warmer than expected, driven by a mass of very hot air from Africa, coupled with a slow moving weather system.

The average temperature in Europe from December to February was 1.4 degrees Celsius above the 1991-2020 average for the northern hemisphere making it Europe’s joint-second warmest winter on record. In 2022, heating degree days – a measure of how much energy is required to heat up buildings during winter – were on average 12% lower than in 2021,

Impact On Gas Supplies and Prices

Europe’s decision to forego Russian gas supplies was met with fears of gas shortages during winter. However, a much warmer-than-expected winter has dramatically changed the situation. Leading to much lower demand for, and much higher inventories of, gas in European countries. It also alleviated fears of gas shortages and reduced the need to refill storage in the summer.

With less demand, and more gas available, this put downward pressure on gas prices, moving futures prices into contango, where pricing for gas to be delivered in the future is lower than pricing for gas to be delivered in the present. The lower future gas prices are encouraging more consumption this summer, as it is cheaper to use gas than other forms of energy. After breaking the €140 per megawatt hour mark in Dec 2022, July 2023 futures prices have since trended downward to just above €40.

The downward trend for some of the Winter 24 natural gas futures has not been as strong, suggesting that prices may remain relatively high until then – with the Jan 24 and Feb 24 futures trading at about €60.

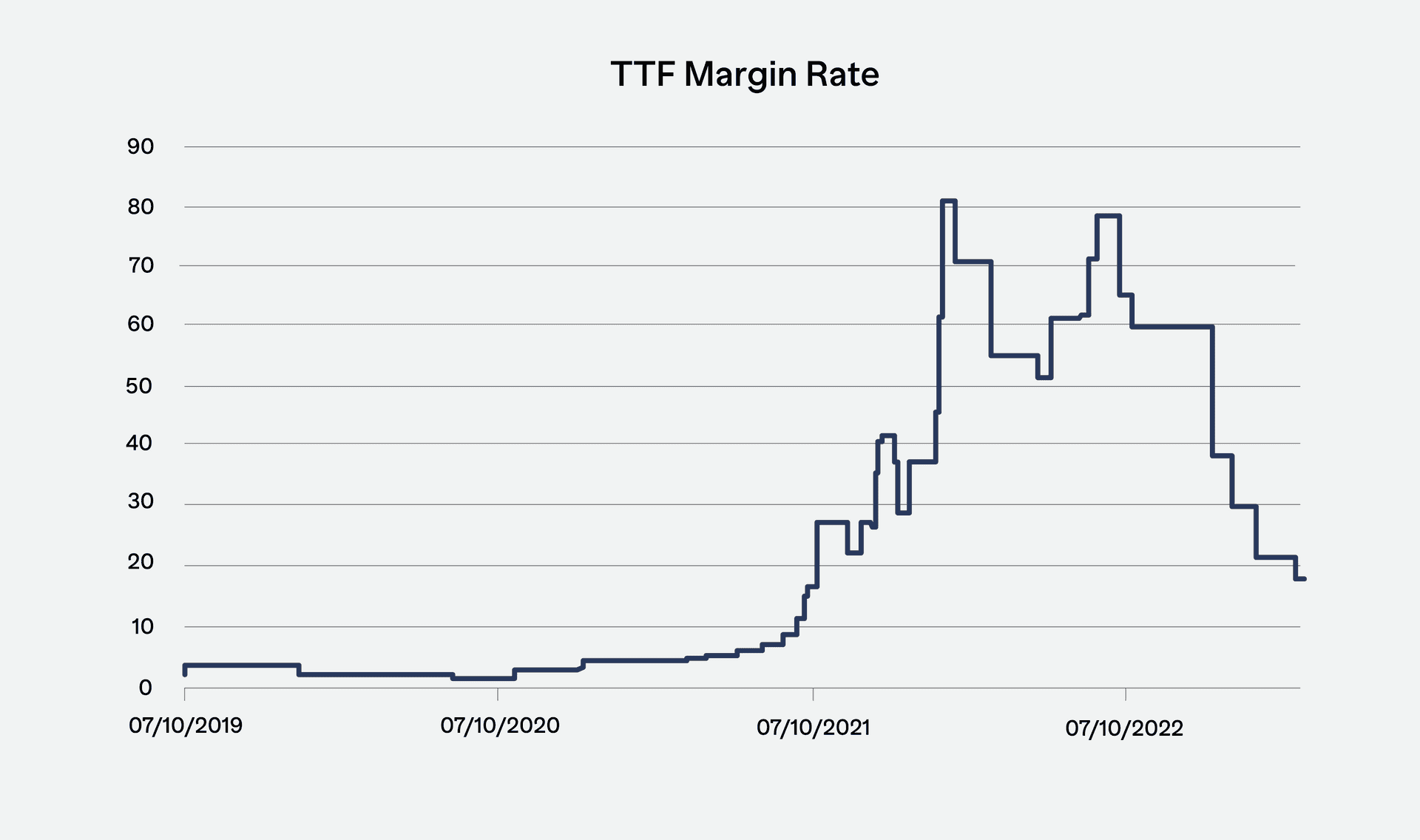

What should also be noted is that some of the largest decreases in margins occurred because the requirements were becoming an unacceptably large percentage of the future price, and not because the analysis performed by the CCPs was automatically showing that they should be reduced. Because of the way that the CCPs determine the margin rate using historical VaR of the underlying price moves, the large changes seen when the prices were high would have suggested that the margin parameters remained at the higher level.

This makes forecasting margins based on potential scenarios even more difficult. What you would normally expect to happen because of the published methodologies isn’t always the case. And if prices rise as is expected then the margin requirements will increase again too.

What You Can Do

- The winter in Europe has been one of the warmest on record.

- Despite the continued conflict in Ukraine and the pressure this has put on supplies, the weather has resulted in high gas supplies and consequently low gas prices.

- This has led to a 75% decrease in margin requirements for gas futures.

- Despite the healthy levels of natural gas stored in Europe, it might not be enough to meet the continent’s heating demands next winter which could prompt renewed levels of heightened volatility – and margin rates – reigniting some of last year’s fears of incredibly large margin calls.

Power and gas markets are often volatile. But add unpredictable weather events to the mix and the volatility can become extreme. This in turn can lead to sudden changes in margin requirements – you would usually expect increases, but depending on the circumstances margins can also fall.

This margin volatility can make it difficult to get funding correct. A sudden increase in requirements can mean that you don’t have sufficient funding in place to cover margin calls and have to resort to expensive borrowing or closing out of positions in a stressed market.

Have buffers set too high and you can find yourself losing potential income. This is even more important when the weather events are leading to lower prices and drops in margin rates. Adjusting funding can often be the last thing you think about in a volatile market, unless you have the tools in place that help you monitor margin levels and project requirements.

The volatile markets can often highlight the idiosyncrasies of the margin algorithms used within the power and gas markets, as well as the different ways in which the necessary parameters are set. These can result in large differences in margin requirements depending on how and where you trade your risk. This can be something that is difficult to determine unless you have the tools available that allow you to consider the different possibilities, be they choice of product, venue or broker, and optimise the costs of trading – in particular the margin required.