Every firm wants to try and achieve cash efficient trading. But with so many trading alternatives, both exchange-traded and bilateral, the fragmented markets and high margin levels mean that traders often need to be incentivised to preserve capital.

The Problem

Current markets have made it difficult to know how best to place risk in order to minimise margin and hence maximise returns. The major changes have been the reduction in the leverage available to firms trading derivatives and the increase in fragmentation from the competing market infrastructure providers.

Pre-2008 available leverage levels were high, but the events of the global financial crisis resulted in increases in regulation and corresponding increases in margin requirements. As more clearing services and trading opportunities were added it became harder for trading firms to manage their portfolios in the most margin-efficient way, with positions ending up spread between multiple venues and margin being calculated on a gross basis. This led to leverage levels dropping significantly, halving in some instances.

The market volatility following Covid and the Russian invasion of Ukraine further compounded these issues. With Initial Margin soaring, leverage dropped even further, making it difficult for firms to achieve cash efficient trading.

At the same time the level of fragmentation has increased. Exchanges look to compete over the most popular contracts, with many being available for trading at 3 or 4 different venues. For OTC products, such as interest rate swaps, there are multiple CCPs offering clearing services. And this is without taking into account the ability to trade products that offer the same or a similar risk profile on a bilateral basis.

Although the peak of margin levels have receded, firms are aware that current geopolitical and climate issues could see them return. The level of fragmentation is also increasing, with more infrastructure firms trying to claim a share of the available business, as can be seen from the number preparing to offer US treasury clearing services.

Trading firms are looking for solutions that can help them make sure they are in the best position in an uncertain market to achieve cash efficient trading. But what functionality do these systems need to support and what steps do firms need to take?

The Solution

Incentivisation

Historically margin wasn’t necessarily thought of as a cost. It was a relatively low percentage of contract value and borrowing to fund it was cheap. But the combination of increased regulation, heightened volatility and higher interest-rates has meant that this is no longer the case. Firms have realised that the cost of margin is an important consideration in the profitability of any trade.

The problem is that trader-specific behaviour can lead to margin inefficiencies. The right thing at a trader level is not necessarily the right thing at the firm level. The trader may not be responsible for margin costs or have any visibility into how requirements are calculated so will not take this into account when deciding how to trade a particular level of risk, or which venue or broker to place their trade with.

Someone needs to be responsible for balancing these conflicting goals and creating the necessary incentivisation by allocating the margin costs via attribution. This is not as easy as it might sound. Most margin is calculated on a portfolio basis, with netting positions reducing the overall requirements. The margin calculated at the firm level will not match the sum of the margin if calculated at the individual trader level.

Firms need to implement a solution that attributes the total margin requirement in a fair and equitable way. There are different ways of doing this and a choice needs to be made of the best method to use. This requires a system that can replicate the various margin algorithms as well as the different attribution methodologies.

Optimisation

Nobody wants to overpay, and this is definitely true of margin. However, it’s not always easy to know how to achieve this, and it requires a system that can consider all the alternatives to find the best solution.

One of the main inputs into high margin is fragmentation. But this is also one of the main sources of optimisation opportunities.

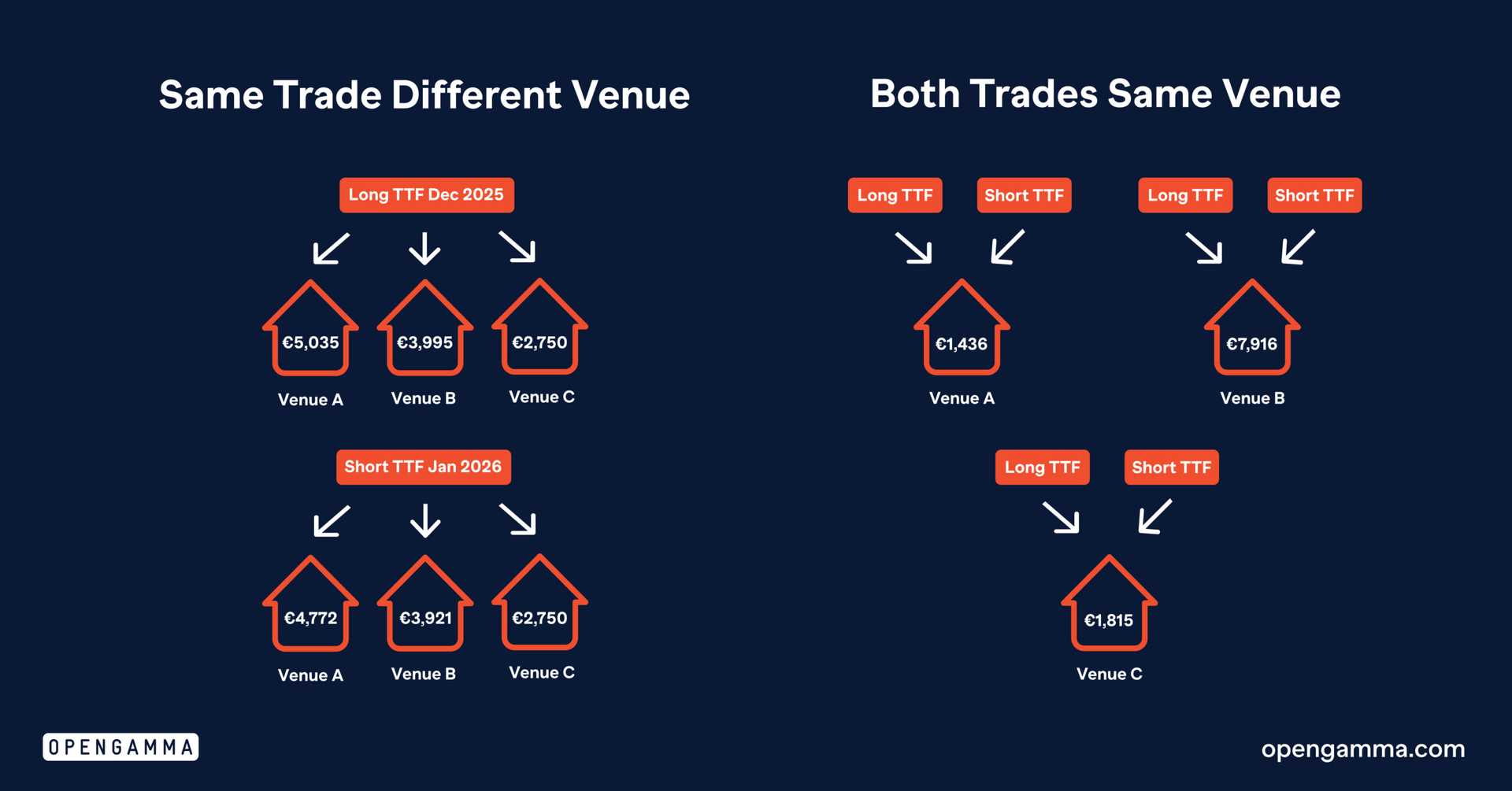

Fragmentation can lead to a loss of offsets in portfolios when margin is calculated using the portfolio-based algorithms that are the norm for most markets. If a netting portfolio is traded across different exchanges, cleared through different brokers or split between cleared and bilateral, any netting benefits will be lost when determining requirements.

But this same fragmentation provides the means to optimise margin. Same or similar products are often traded on multiple exchanges, and although based on the same or similar regulation, the level of margin requirements can vary considerably. It is also important to make the correct choice of broker; a margin may be lower for an outright position on one exchange, but adding to offsetting positions already cleared through another broker may attract a lower margin.

Some of the biggest optimisation opportunities come from the choice between cleared and bilateral. In many circumstances no initial margin is required for a bilateral position, although you will be swapping liquidity risk for counterparty risk. Where margin is charged on bilateral trades, it tends to be much higher than that charged for cleared so this needs to be taken into consideration.

Conclusion

In order to achieve cash efficient trading, firms need to use:

- Attribution to incentivise traders to consider margin costs in their trading decisions.

- Optimisation to reduce overall margin levels, using the available choices of venue for trading the same risk to minimise requirements.

Firms who use OpenGamma have been able to achieve significant reductions in their margin requirements, with savings of over 30% being regularly achievable. They are able to determine not just the savings that can be made at a given point in time, but also forecast how those requirements will change over time in order to assess total funding costs.